Plan Today to

Secure Tomorrow

Comprehensive Approach at Ermlick Retirement Planning

Ermlick Retirement Planning Is a comprehensive, fiduciary advisory firm that focuses on retirement preparation, guiding our clients to and through retirement. We are proud partners of Cornerstone Senior Services and First Advisors National, and often work in tandem with CPAs, tax professionals, and estate attorneys. Together with our partners, we work to simplify the complex task of retirement planning and provide our clients with straightforward strategies. As a firm committed to fiduciary standards, we assure you that we will always be open and prioritize your best interests. Ermlick Retirement Planning is here to help every step of the way.

Free Educational Events & Workshops

Maximizing Social Security

Medicare 101

At Ermlick Retirement Solutions, we are committed to helping people understand the many aspects of retirement that they will face when they stop working. Be a part of a community that’s planning ahead. Get helpful tips and stay informed on important topics that affect your retirement. We hold ongoing workshops, both in person and online via Zoom, that you can attend free of charge. Sign up to be the first to know about upcoming events near you or online!

Our Services at Ermlick Retirement Planning

At Ermlick Retirement Planning, we specialize in designing and implementing personalized retirement solutions and strategies that guarantee income to last through your retirement. Our goal is to empower those in or nearing retirement to take control of their financial futures, guiding our clients through the intricacies of retirement income planning, protection, and wealth preservation strategies. Here are just some of the services we may provide as part of your custom retirement plan.

Retirement Income Planning

- Maximize Social Security Benefits

- Maximize Pension Benefits

- Guaranteed* Lifetime Income Options

Investment Advisory Services

- Fiduciary Services

- Risk Management

- Continuous Monitoring

Medicare Plans

- Enrollment Guidance

- Coverage Analysis

- Cost Optimization

- Annual Review

Social Security Maximization

- Timing Considerations

- Maximizing Claiming for Couples

- Divorced Benefit Claiming

Legacy & Estate Planning

- Tax Advantaged Estate Planning Strategies

- In Conjunction with Estate Attorneys

- Insurance Products

- Wills and Living Trusts

Long-Term Care Insurance

- Coverage Options

- Asset Protection

- Customized Planning

Life Insurance

- Financial Protection

- Risk Mitigation

- Estate Planning

- Advanced Planning and Estate Tax Mitigation

Tax Planning

- Long-Term Planning

- In Conjunction with CPAs and Tax Professionals

- Roth Conversion Planning

- RMD (Required Minimum Distribution) Planning

401(k) Rollovers

- 401(k), TSP, 403(b) and Similar Retirement Account Rollovers

- In-Service Rollovers (No Tax Penalty Beginning at Age 59-1/2)

- IRA Options, Traditional and Roth

Federal Benefits

- Retirement Benefits Planning

- Insurance Planning

- Health Insurance Benefits

- TSP Rollovers

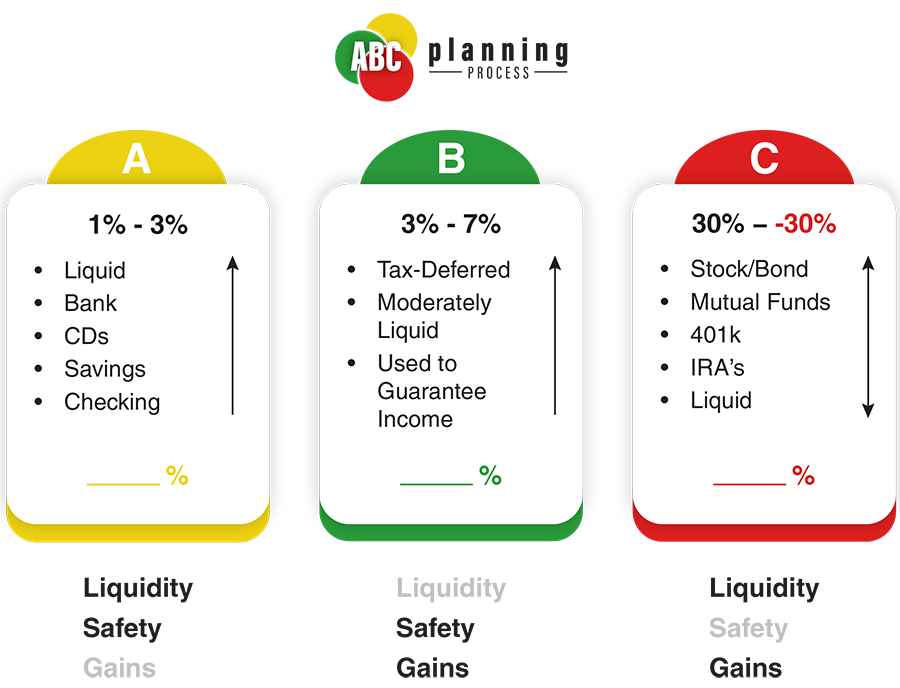

What Are the ABCs of Retirement Planning?

When it comes to your investments during retirement, you need all three of these things:

- SAFETY

- LIQUIDITY

- GAINS

Featured Headlines

Resource Library

Browse through the educational resources on our website to learn more about retirement—before you retire. We invite you to read, watch, download, and learn. And remember, we are here to help you develop and implement your own personalized retirement plan. Please reach out to discuss your situation, we want to hear from you.

Contact Us

Our experienced team is ready to help you customize a plan to fit your specific retirement needs and can meet with you online from anywhere, or at one of our office locations. We can help you guarantee income for life, minimize risks, and leave behind a lasting legacy for your loved ones. If you would like to schedule a complimentary, no-obligation consultation or second opinion review, please contact us today!

Schedule a Free, No-Obligation Appointment

Call us at (703) 338-7103, email us here, or fill out this simple form. You can also schedule your own appointment online!

Serving VA, MD, D.C. & Licensed in Most States

© 2026 Ermlick Retirement Planning | David Ermlick. All Rights Reserved. Investment advisory services are offered through First Advisors National, LLC (“FAN Advisors”). FAN Advisors is an investment advisor firm registered pursuant to the regulations of the U.S. Securities and Exchange Commission (SEC). FAN Advisors written disclosure document (FIRM BROCHURE) is available upon request; please review it for details regarding our advisory service recommendations and associated fees. Your investment advisor representative is registered with FAN Advisors to recommend only the specific advisory services available through FAN Advisors.

*Guarantees are provided by the financial strength and claims-paying ability of insurance companies, some of which have been around longer than 100 years.